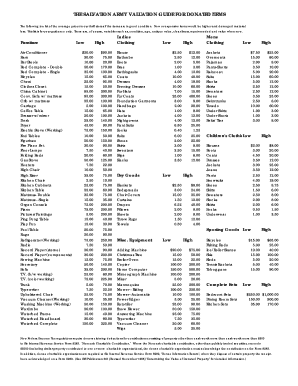

Salvation Army Valuation Guide Spreadsheet

Item Value Man's or Woman's Shirt $ 2.50 - $12 Woman's Sweater $ 3.75 - $15 Children's Clothing $ 3 - $12 Man's Suit $ 15 - $60 Woman's Evening Dress $ 10 - $60 Kitchen Table Set $ 35 - $170 Sofa $ 35 - $200 Desk $ 25 - $140 Floor Lamp $ 6 - $50 It's important to remember that the value of the donated item is not equal to how much money you originally spent on it. Instead, the item is valued at how much it is worth when it is donated. In other words, if you originally spent $40 on a sweater, it may only be worth $5 after it has been used. Be careful of overvaluing your items, as it is a red flag for the IRS. Related Articles.

Other Ways Value Your Donated Items If you are uncomfortable assigning a value to your donated items, don't worry. There are lots of resources to help you figure out how best to value your donations. It's Deductible is provided by the good folks at Intuit of TurboTax fame.

It is a program that allows you to keep a running total of all your donations as you give them and automatically provides a value based on a database of several thousand goods and current blue book estimates. What's especially nice is that if you use TurboTax to prepare your taxes, you'll find that you can simply import the information onto your tax form. Even if you don't use TurboTax, the information is well-organized and easy to use come tax time. Other Valuation Guides Often when you donate items to a charity, they will give you a receipt and leave it blank so that you can fill in the amount you think the items are worth. Therefore, the following places provide valuation guides to help you figure out what the fair market value of your donated item really is:.

A long list of the most commonly donated items including clothing, appliances and household items. Goodwill provides a downloadable guide that covers everything that you could conceivably donate to Goodwill.

Many third party tax preparers such as H&R Block use these two guides to help their clients value donated items. IRS Regulations on Donation Values The has strict guidelines with regards to estimating value for charitable donations. Keep in mind the limits set for deductions before estimating the value of items you donate, because while some donations do not require additional IRS forms when requesting a deduction, some amounts will certainly result in extra paperwork. Amounts of $250 require documentation from the charitable organization. An IRS Form 8283, Section A is required for charitable donations exceeding $500 that are noncash donations. An IRS Form 8283, Section B is required for charitable donations exceeding $5000 that are noncash donations. High-Priced Donated Items The IRS has special regulations for estimating the value of high-priced items that are donated to charity.

For example, objects of art that are valued at less than $5000 require a written appraisal from a qualified professional. Art objects valued over $20,000 must have an appraisal as well as a photograph and detailed description of the object attached to the tax return. Art objects valued over $50,000 require an entirely different process involving requesting a Statement of Value from the IRS (which involves a fee of $2500 for the request) and the art might wind up being examined by an IRS official before the tax deduction is allowed. Cash Donations Cash donations generally are much easier to value since the amount you donate is the.

Stocks, annuities, life insurance and patents are a little more difficult to estimate with regards to the value, but the IRS has regulations in place explaining the value estimation process for donations such as these as well. Seek Professional Advice It is a good idea to consult a tax professional if you are planning on making a sizable donation to a charity. A professional can make sure that you are in compliance with tax guidelines and requirements and will be able assist you with receiving a credit for your donation. Was this page useful?

I have wanted to do this post for a very long time but, unlike in the US, here in Canada we are unable to track the drop-off donations we bring to a thrift store for tax purposes. As a result I really didn’t feel qualified to tell you how it’s done. So I’ve brought in the best of the best., a very well known Professional Organizer in the US, is here to help simplify the matter for us. I appreciate her time and attention to this post and I do hope you find it helpful. Welcome Geralin!

The days are short, the nights are long and we tend to spend more time indoors – surrounded by our belongings. It’s the perfect season to rid our homes of unwanted stuff and by that I mean things that we no longer use, like, want or need. Items like: clothes, handbags, luggage, furniture, decorative items, toasters, costume jewelry, or artwork to name a few. In other words, clutter.

Less clutter means more space and more unoccupied space means less time spent maintaining items; less time spent maintaining items means more free time to do whatever it is we want to do. As a professional organizer, one thing I feel confident saying is that very few of us, the well-organized among us included, want to spend more time doing laundry, dusting, vacuuming and maintaining our ‘stuff.’ We want to hang out with our families and friends doing fun activities. Or, doing nothing at all. Fortunately, we have options. Many options.

Options for permanently decluttering stuff include consigning or selling on eBay or a yard sale. If you’ve ever hosted a you know they can be a lot of work. They are time consuming and aren’t always profitable. While some folks think consigning and selling are well-worth their time and effort, others believe the opposite to be true.

Salvation Army Valuation Guide Spreadsheet

They’d much rather simply donate their stuff to a charity. How to Track Drop-Off Donations for Tax Purposes Donating goods not only helps us declutter, it also helps us financially by earning tax write-offs. Plus, in addition to earning a tax write off, it’s nice to know we are helping the needy while decluttering our closets, countertops and cabinets. I usually go conservative (Yard sale pricing) when it comes to estimating the value of an item. I recommend to my clients, to create a spreadsheet template and reuse it everytime you have a drop off. Print it out and attach it to the donation slip they give you. If you don’t have time to write up the detailed list, take a pic of each donated item (zooming in on the tags if they are clothing or name brand).

Then, add the pictures to a file and write up the resale price later. Thanks for sharing/. I found it is better financially, and easier, to donate. I use Turbo Tax and for instance they allow you to write off $4 for a hardcover book in good condition, which will give me back about $1 in tax refund (still far less than the $25 I paid for it).

In a yard sale, if I was lucky enough to sell it, I might get 25 cents. It is far less work to keep a clipboard handy and write down each item as I toss in in the donation box, then to sort it out, price it, drag it out into the yard and back again when it doesn’t sell. I have always made good money on yard sales compared to my neighbors but it still isn’t worth the work. My time is much more valuable. Plus I feel good knowing I am helping others.

Salvation Valuation Guide

The best way to save money on an item is not to buy it in the first place (my father’s wisdom).